The Obama Administration explains its plans for reforming the U.S. housing market: less government involvement, more private capital.

On February 11, 2011, the U.S. Department of the Treasury and the U.S. Department of Housing and Urban Development delivered a report to Congress describing the Obama Administration’s plan to reform the U.S. housing finance market. The report explains the Administration’s goal "to scale back the role of government in the mortgage market, and promote the return of private capital to a healthier, more robust mortgage market."

The Administration’s plan calls for reducing and eventually winding down the two primary government housing finance institutions, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). After significant numbers of these institutions’ mortgage loans defaulted, Congress passed the Housing and Economic Recovery Act of 2008, placing Fannie Mae and Freddie Mac under the full control of the Federal Housing Finance Agency (“FHFA”). The Administration now intends to work with the FHFA to reduce government involvement in these institutions, while recommending that the FHFA work with other agencies to reintroduce more private capital into the mortgage market.

The Administration’s plan calls for reducing and eventually winding down the two primary government housing finance institutions, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). After significant numbers of these institutions’ mortgage loans defaulted, Congress passed the Housing and Economic Recovery Act of 2008, placing Fannie Mae and Freddie Mac under the full control of the Federal Housing Finance Agency (“FHFA”). The Administration now intends to work with the FHFA to reduce government involvement in these institutions, while recommending that the FHFA work with other agencies to reintroduce more private capital into the mortgage market.

The Administration’s plan announced earlier this month would address a part of the mortgage industry that Dodd-Frank left unaddressed. It would shift the government’s role from one of direct involvement in the home mortgage market to oversight and enforcement of consumer protection laws.

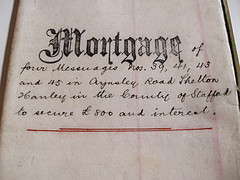

Image by Flickr user Rev Dan Catt, and used under a Creative Commons license.