Recent book highlights flaws in mandatory information disclosure as consumer protection policy.

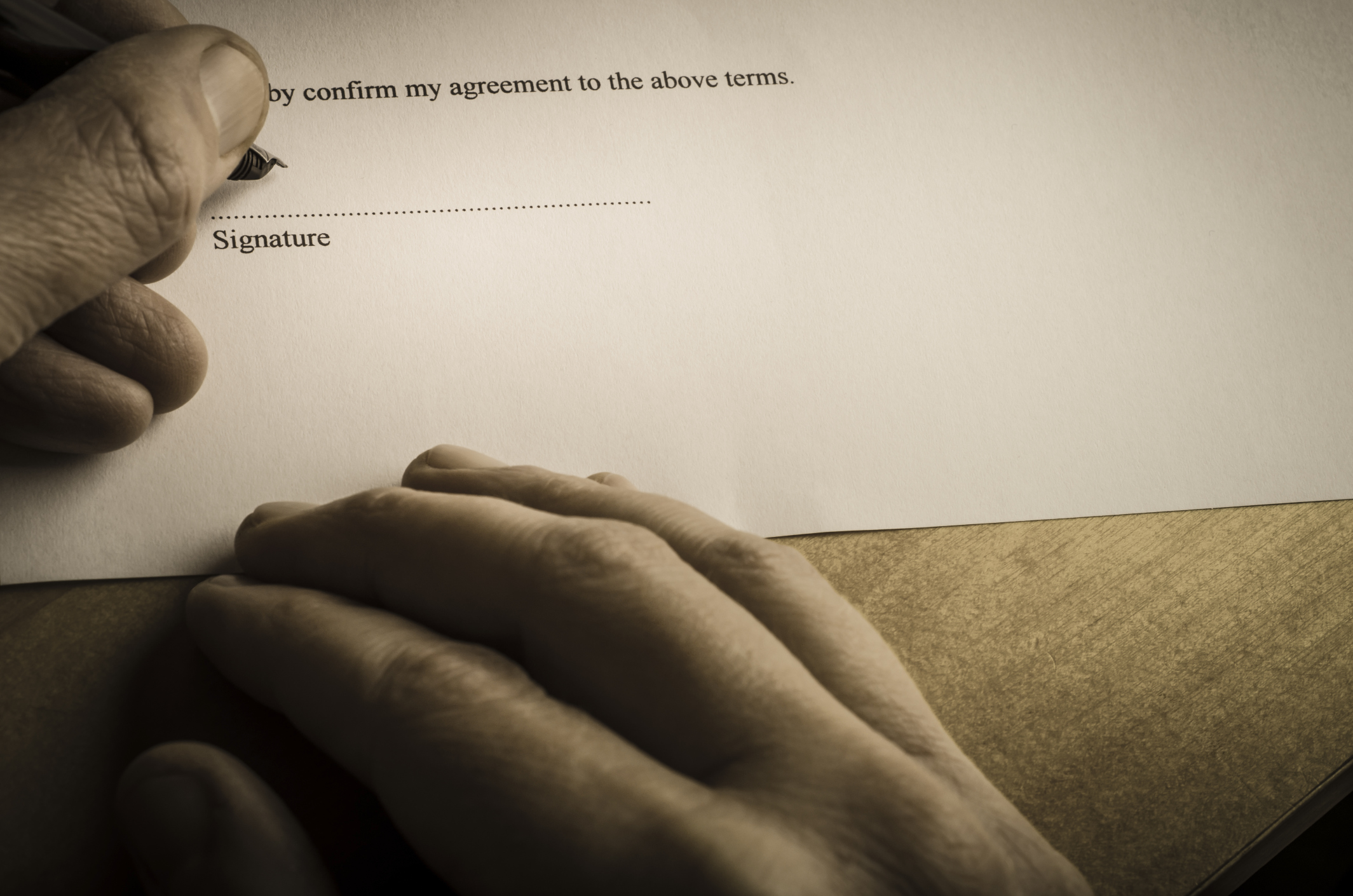

Mandated disclosure reigns triumphant. Disclosure requirements appear everywhere: tort law (“duty to warn”); consumer protection (“truth in lending”); bioethics and health care (“informed consent”); online contracting (“opportunity to read”); food law (“nutrition data”); campaign finance regulation; privacy protection; insurance regulation; and more. Corporate scandals and financial crises ceaselessly spawn new disclosure laws: the Securities Act of 1933; the Truth-in-Lending laws of the 1960s and 1970s; the Sarbanes-Oxley Act of 2002; and the Dodd-Frank Act of 2010.

As we explain in our book, More Than You Wanted to Know: The Failure of Mandated Disclosure, mandated disclosure’s triumph is understandable. Mandated disclosure aspires to help people making complex decisions. It does so by requiring more sophisticated or knowledgable specialists to reveal information to less sophisticated or knowledgable individuals so that the latter can choose sensibly and the disclosers do not abuse their position. The theory is seductively plausible. After all, don’t people make poor decisions because they have poor information? Won’t they make good decisions with good information?

Mandated disclosure also alluringly fits all ideologies. Richard Thaler and Cass Sunstein like it because it is “libertarian paternalistic.” Corporations would prefer to disclose than face other forms of regulation. So legislatures pass disclosure mandates, sometimes unanimously.

But mandated disclosure is much like Kennedy’s description of his rising public approval ratings after the Bay of Pigs: “The worse I do, the more popular I get.” Or it’s like Dr. Johnson’s description of second marriages: “the triumph of hope over experience.”

The fact is that disclosure does not work; it cannot be fixed; and it can do more harm than good. It has failed time after time, in place after place, in area after area, in method after method, and in decade after decade.

Mandated disclosure’s failure is no stranger than its widespread popularity. It generates all the fine print that everybody derides, the interminable online sales terms everybody clicks agreement to without ever reading. Disclosures are not read because they describe complex facts in complex language. Most people little like the former and little understand the latter. The very lack of sophistication and expertise that purportedly justifies mandated disclosure means that people will not be able or willing to use the complex information disclosed.

If disclosure could work, it would be working by now. For decades, able policymakers have ingeniously tried method after method. The attempts are legion: full and summary disclosure; advance and real-time disclosure; oral and written disclosure; disclosure in words and in numbers; disclosure in boxes and in charts; disclosure in depth and in scores; disclosure by guidelines and by formulas; disclosure in print and on line. Still, success always remain around the corner.

Today, ardent and thoughtful “disclosurites” argue that simplification is the answer. But decades of simplification efforts have also yielded little progress.

Behavioral economics is sometimes offered as the solution. But behavioral economics actually provides the explanation for why mandated disclosure has so consistently failed. People perceive and process information in so many distorting ways that no mandate, however complicated, can account for them all. Studies show, for example, that people’s “heuristics and biases” are so unpredictable that designing disclosure to overcome one bias can just trigger another.

In some markets, “information intermediaries” digest complex information and can disseminate advice to less sophisticated individuals. But intermediaries, when present and reliable, are much better substitutes for, not complements to, mandated disclosure. Intermediaries do not even need disclosure mandates to do their work.

Mandated disclosure, it is often recognized, fails because of the “overload problem.” But mandated disclosure is also defeated by a separate “accumulation problem.” People not only face a clutter of information within each disclosure; they face a clutter across disclosures. The accumulation problem arises because disclosees are confronted with so many disclosures each and every day.

The accumulation problem stymies even sophisticated regulators who seek to solve overload problems by subjecting individual disclosures to cost-benefit analysis (CBA). Even assuming that disclosure regulations could be subject to meaningful CBA—although John Coates argues convincingly that they cannot be – regulators have neither the tools nor the insight to design new disclosures that overcome the accumulation problem.

Consider an example showing why CBA of financial disclosure regulation is futile (a point we developed more fully in a recent article). Mortgage loans, as everyone knows, have complex terms and complex disclosures. Under the Dodd-Frank Act, the Consumer Financial Protection Bureau (CFPB) tried to simplify these overloaded disclosures. The CFPB used experimental methods to create admirably improved forms that scored well in the lab experiments. But when making real decisions, borrowers at a closing receive at least 50 different forms, of which the CFPB’s is only one. Other statutes demand other mortgage disclosures, each intended to alert consumers to other aspects of the transaction. Even though the CFPB may have created a fine form, borrowers in reality get a stack of forms that can easily exceed a hundred pages. Even if each of these forms were as well-designed as CFPB’s, nobody could read them all.

The problem is that no single agency has the authority to whittle away at the stack. Lawmakers who mandate disclosure effectively graze at a public commons called “people’s attention.” Each mandate draws a bit of this attention, degrading the ability to attend to other things. Lawmakers never consider the cumulative effects of the disclosures they require, as they are focused on the immediate problem before them. Moreover, in the contemporary legal system, so many law-makers try to solve so many problems using disclosure that the already overgrazed commons becomes daily more depleted.

We are often asked what should replace mandated disclosure given that it doesn’t work. Our answer is that nothing necessarily needs to replace something that doesn’t work. If mandated disclosure does not work, nothing is lost in abandoning it – and perhaps something, like lessened frustration and distraction, can be gained. It is important to recognize that not only is mandated disclosure not a panacea, but so too are other promised easy and simple solutions. Sometimes the policymaker will just need to bite the bullet and consider which social problems actually need meaningful regulatory responses and then seriously assess what kind of response will actually help ameliorate the problem.

This essay is part one of a seven-part series on The Regulatory Review entitled, Is Mandatory Disclosure Helping Consumers?

Omri Ben-Shahar and Carl Schneider are the authors of More Than You Wanted to Know: The Failure of Mandated Disclosure.