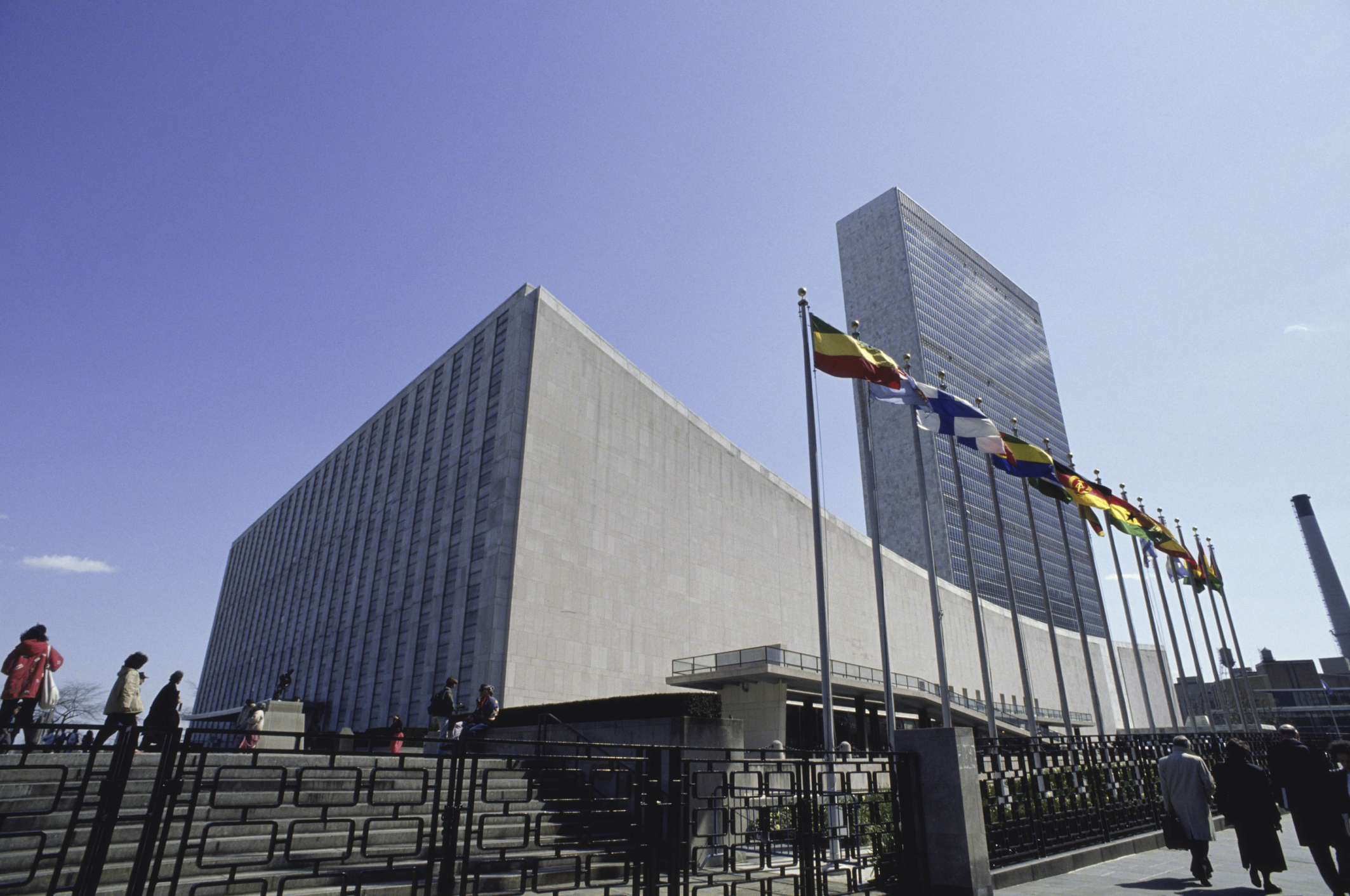

Treasury Secretary Jack Lew leads delegation to U.N. conference on development finance.

International finance has the potential to aid the developing world by supplying essential resources that support infrastructure growth and facilitate interstate cooperation. As public and private actors form partnerships around development finance, the potential for growth multiplies.

Recently, the United Nations held the Third International Conference on Financing for Development in Addis Ababa, Ethiopia. U.S. Treasury Secretary Jack Lew, speaking at the conference and representing a delegation of White House and executive agency attendees, discussed five new and recent international partnerships designed to further the goals of development finance worldwide.

The first partnership, the Addis Tax Initiative, is meant to help developing countries gain the capacity to fund themselves by “building effective revenue and expenditure systems.” By mobilizing their own resources, developing countries could gain the ability to manage their internal operations and fund their own development efforts in the future.

To supplement this tax initiative, the Partnership on Illicit Finance aims to ensure that these tax revenues are raised and managed legally. The Partnership will bring African partners and the U.S. together to “address the generation and movement of proceeds from corruption and other financial crimes” throughout Africa, which could strengthen foreign investor confidence as well.

The third partnership is designed to empower developing countries to use data effectively in order to support development. Secretary Lew emphasized the need for adequate data collection and management of various development measures such as health, climate resilience, and education.

Financial services data can serve as general quality-of-life measures as well. The World Bank tracks financial inclusion data in its Global Findex, a database funded by the Bill & Melinda Gates Foundation that provides “data on how individuals save, borrow, make payments, and manage risks.” Many other policy-making institutions, such as the Alliance for Financial Inclusion and Transact, the National Forum for Financial Inclusion in the U.K., also measure and track similar information as they work with their member countries and institutions to develop growth initiatives.

The fourth initiative is a recent partnership between the U.S. and Power Africa-E.U. to expand electricity access throughout sub-Saharan Africa. By offering financial support, loan guarantees, and technical assistance for power generation and distribution, this initiative has leveraged over $20 billion in private investments in less than two years.

Finally, Secretary Lew discussed progress made on behalf of the Global Financing Facility, an international program focused on supporting vulnerable women and children by accelerating investments in health-services provisions to populations suffering from preventable deaths and other health problems related to child birth and development.

Development finance can promote growth by providing access to capital for infrastructure development, public investments, financial services operations, and agricultural development. It comes in three forms: private investments (which make up the largest share of development finance), domestic resources, and “official development assistance,” such as—usually foreign—assistance from states, international organizations, and institutions like the World Bank.

The goals of development finance are to end extreme poverty by delivering services that sustain public health and to mobilize private sector investments for future development. Often in the developing world, private investments fail to attract lenders because regional instability creates unmanageable risks. Development assistance, often given with more borrower-friendly terms (or simply as a grant), creates opportunities for developing countries to establish an infrastructure that can support future investments. As Secretary Lew stated, official development assistance “is most powerful when it is used to leverage and encourage increased investments by others.”

The conference comes thirteen years after the U.N. first sponsored a summit-level meeting to address financial issues related to global development. Since then, according to Secretary Lew, development finance has helped lift nearly 800 million people out of extreme poverty and has “halved the number of hungry and those without access to safe drinking water.”

The delegation included members from the White House, the Treasury and State Departments, the U.S. Agency for International Development, the Overseas Private Investment Corporation, and the Millennium Challenge Corporation. Participants at the conference included heads of state, ministers of finance and development, and private and non-governmental institutions involved in development finance worldwide.

The U.S. is the world leader in providing development finance. Last year, the U.S. provided nearly a quarter of all development finance worldwide. The U.N. recently endorsed the conference’s action agenda. Secretary Lew’s remarks, together with the support received from the international community, suggest that both public and private development finance will continue to grow as sources of humanitarian relief and economic growth worldwide.