Rent-seeking and profit-seeking behavior provide valuable insights into the concept of regulatory capture.

Regulatory capture is a problem. This is a point on which there is broad, bipartisan agreement, as demonstrated by a recent nonpartisan forum organized by the Administrative Conference of the United States as well as by this very The Regulatory Review series on this issue. But the answers to several critical questions remain up for debate. For one, what, precisely, is regulatory capture? Further, why is capture a problem? Finally, what can be done about it?

To answer these questions, it is worth reviewing the insights of George Stigler, the Nobel Prize-winning economist who is most associated with the concept of regulatory capture. Stigler’s economic theory of regulation observed that the government’s special resource—which private entities do not possess—is the power to coerce. Interest groups that can convince the government to use its coercive power for their benefit can earn economic rents at the expense of others. With this foundation, Stigler was able to show why regulation tends to get “captured” by well-organized interest groups acting to maximize their own well-being, often at the expense of broader society.

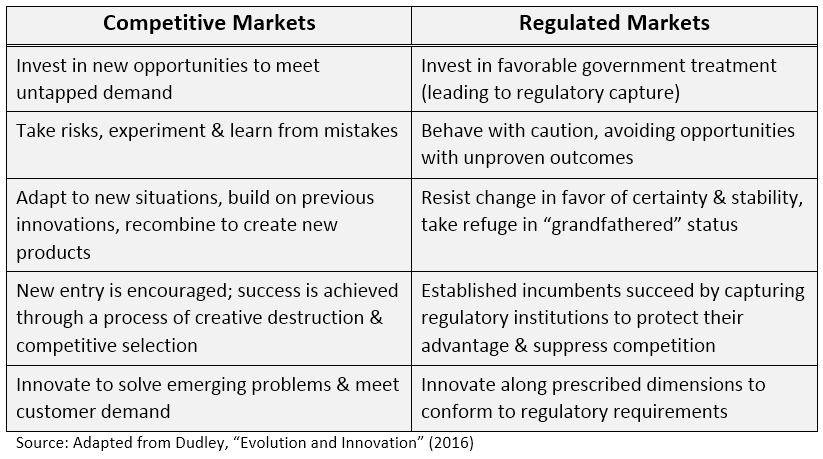

Stigler’s contemporaries, James Buchanan (also a Nobel laureate) and economics professor Gordon Tullock, were also concerned about the socially undesirable consequences of regulatory capture and the rent-seeking behavior that accompanies it. They distinguished “rent-seeking”—when people attempt to gain economic rewards through favorable government treatment—from “profit-seeking,” when people attempt to create rewards by discovering and acting on new opportunities.

With respect to profit-seeking behavior, Buchanan observed that “profit-seeking entrepreneurs generate a dynamic process of continuous resource reallocation that ensures economic growth and development,” which, as an unintended byproduct, leads to “socially beneficial consequences.” As Adam Smith famously wrote, “it is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.” More importantly, in a competitive market environment, those returns that initially accrue to a successful entrepreneur are quickly competed away by other profit-seeking entities, ultimately redounding to the benefit of consumers in the form of lower prices.

In contrast to profit-seeking, rent-seeking emerges when regulation or other political intervention in markets creates opportunities for some people to gain “rights” that only the government can confer. This rent-seeking behavior is a perfectly rational response to the opportunity presented by regulation, and it leads the most well-organized interests (which may be, but are not necessarily, the regulated parties) to try to capture the regulators. But rather than creating new opportunities and value for consumers, such behavior leads to socially wasteful uses of resources, as talent and energy get channeled into lobbying for favorable government treatment, rather than into entrepreneurial experimentation and innovation that enhance social welfare and lead to growth and prosperity.

Put simply, the motivation for both profit-seeking and rent-seeking is identical: to maximize economic returns. “The difference lies in the unintended results,” as Buchanan, Tullock, and their co-author Robert Tollison once put it. Competitive market pressures encourage profit-seeking behavior. These pressures have the unintentional benefit of lowering costs and increasing quality for consumers, and they encourage innovation and growth. Regulatory pressures, on the other hand, encourage rent-seeking behavior, which often end up protecting vested interests and harming consumers.

This leads to a very basic insight: Regulatory capture would not exist without regulation. As Buchanan observed, “Rent-seeking activity is directly related to the scope and range of governmental activity in the economy, to the relative size of the public sector.” Thus, in deciding whether to regulate, legislators and policymakers should first understand and respect the socially beneficial side effects of market competition, and they should recognize that even the most well-intentioned policies can lead to regulatory capture. We live in a diverse society made up of individuals in varied circumstances and with different preferences. Regulatory approaches at the national (or supranational) level that reduce competition, choice, and feedback make regulatory capture inevitable, protect favored interests from challenge, and make the economic ecosystem as a whole less able to adapt and innovate.

That being said, some regulation is necessary—and, when it is, the form that it takes will significantly influence the extent to which special interests could capture it. To minimize opportunities for capture (and to maximize social welfare), regulation should be designed to address an identified market failure and to preserve freedom of choice and competition. To illustrate, a simple carbon tax would be far more effective at addressing concerns about climate change (an externality)—and much less susceptible to regulatory capture—than will be the current, complex maze of regulations that limit source-specific emissions, restrict the appliances a consumer can buy, and mandate vehicle fuel economy. Similarly, if regulation is necessary to correct for asymmetric information, then providing greater information to the public would be a more effective means of eliminating capture than imposing mandates and bans.

As long as there are regulations, interest groups will attempt to hijack the coercive apparatus of government to their own benefit. The best way to reduce regulatory capture is a two-fold endeavor: first, government must show restraint in what it regulates; and, second, when intervention by government is absolutely necessary, it must use forms of regulation that focus narrowly and directly on clearly identified market failures and preserve competition and freedom of choice.

This essay is part of The Regulatory Review’s sixteen-part series, Rooting Out Regulatory Capture.