OIRA should add a benefit-cost analysis focused on protecting the poor when evaluating new agency rules.

Over a year ago, President Joseph R. Biden called for modernization of the federal rulemaking process to advance the interests of marginal, disadvantaged, minority, and vulnerable populations. In this essay, I propose an innovative process for the White House Office of Information and Regulatory Affairs (OIRA) and federal agencies to respond to President Biden’s directive.

Under President Bill Clinton’s Executive Order 12866, which still applies today, the standard benefit-cost analyses prepared by federal regulatory agencies ensure that the society-wide benefits of a rulemaking justify the society-wide costs of the rulemaking—a social efficiency test. Yet, although Executive Order 12866 does authorize distributional considerations, no special consideration is given to the interests of low-income Americans.

I recommend that this practice change. Each major rulemaking should also include a benefit-cost analysis from the perspective of low-income Americans. In philosophy, the notion of giving special attention to the well-being of the worst-off citizens is sometimes called “prioritarianism.”

The U.S. Census Bureau’s definition of poverty, which covered 37.2 million Americans in 2020, could be used to implement this new equity test. Black, Hispanic, and other people of color account for a disproportionate share of impoverished Americans. A new prioritarian equity analysis would enable regulators to determine whether the benefits of a major rule for the poor justify the rule’s costs to the poor. Such an equity analysis would also help federal agencies and OIRA, in collaboration with the White House and the U.S. Congress, to devise regulatory alternatives that are good for the poor as well as for the entire society.

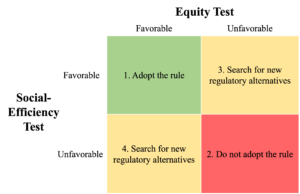

Under my proposal, the analysis of any major rule could have four possible outcomes as described and illustrated below.

1. The social-efficiency and equity tests are both favorable, in which case the agency should adopt the rule.

2. The social-efficiency and equity tests are both unfavorable, in which case the agency should not adopt the rule.

3. The social-efficiency test is favorable, but the equity test is unfavorable, which should trigger a search for new regulatory alternatives that protect the interests of the poor without compromising society’s welfare.

4. The social-efficiency test is unfavorable, but the equity test is favorable, which should trigger a search for new regulatory alternatives that better advance society’s interests without compromising the favorable impacts on the poor.

In options three and four, the magnitudes of the tradeoffs should be considered. For instance, if each poor person gains $100 per year and society loses $100, the interests of the poor should prevail. Regulators should use their judgment in borderline cases.

To illustrate this modernized regulatory analysis, consider first a case about U.S. Environmental Protection Agency (EPA) regulation. Congress authorized the EPA to regulate toxic air pollution emitted by factories into nearby communities through the Clean Air Act. (Except with respect to electric utilities, Congress does not currently authorize cost-benefit balancing for toxic air pollution, but the Clean Air Act could be amended to authorize the proposal I have sketched.) In the case of coke production, which is part of the integrated steelmaking process, the populations living near coke plants are disproportionately low income and they are exposed to a mixture of pollutants linked to elevated risks of lung cancer.

A strict emissions limitation would likely pass an equity test as poor people would garner much of the public health benefit while the costs of the regulation would be spread broadly among consumers who purchase products made of steel, such as new cars and trucks. But would the EPA regulation on coke production pass the social-efficiency test? Maybe not, as the size of the exposed population is relatively small and the capital and operating costs required to control air emissions from coke plants are relatively large. In this case, however, EPA might reasonably move forward on equity grounds even though the social-efficiency case is doubtful.

Alternatively, EPA might set a somewhat less stringent standard on coke plants to ensure social efficiency, yet work with industry actors to allocate some of the compliance savings to anti-smoking and radon control programs in communities near coke plants. This less stringent standard, coupled with community health programs, might do more for lung cancer prevention, social efficiency, and equity than the strict emissions limitation.

Congress also authorized EPA to reduce toxin exposures by issuing drinking water standards under the Safe Drinking Water Act. For a contaminant such as arsenic, which is also a cancer-causing agent, EPA may find that the society-wide health benefits from arsenic control justify the costs of equipment to control arsenic. Would a uniform national arsenic standard benefit the poor? Possibly not. The costs of stricter drinking water standards are typically passed on to consumers through higher water bills. For low-income Americans in rural communities—where there are relatively few residents and businesses to pay for arsenic control—the higher water bills may be a more pressing concern than the modest health risks from naturally occurring levels of arsenic in drinking water.

The disproportionate impact of water bill costs on low-income Americans helps explain why EPA is under intense pressure to better account for “affordability” when setting new drinking water standards. To make a program that is more beneficial to low-income Americans, EPA could be authorized to use federal infrastructure subsidies to help pay for arsenic control in low-income rural communities, which would lessen or eliminate the increase in water bills. This approach could be implemented under EPA’s current authority if the Biden Administration and Congress are willing to allocate some infrastructure subsidies to low-income communities.

Notice how the mere presence of the equity test, as a supplement to the social-efficiency test, induces OIRA and regulatory analysts to perform new kinds of regulatory analyses and be more creative about the design of regulatory alternatives.

Is equity analysis feasible? Elsewhere, I have looked carefully at that question in the context of safety, tailpipe, and fuel-economy regulations of the automobile industry. I found that such analyses are feasible but federal agencies will need to invest in new data-collection systems to implement the equity tests. Given President Biden’s interest in this issue, now is an opportune time to change the way OIRA and federal agencies conduct regulatory analysis.

The author expresses appreciation for the helpful suggestions from Cass Sunstein and Megan Russo on a previous version of this essay.

This essay is part of a nine-part series entitled Creating an Administrative System for All.