PPR seminar examines factors behind Chile’s bounce back from 2010 earthquake.

Within just a few minutes, buildings collapsed, infrastructure broke, and hundreds of people lost their lives. The earthquake that rocked Chile in 2010, one of the largest in history, measured a magnitude of 8.8. The ensuing damage wiped out roughly 18% of the country’s GDP. Yet the country demonstrated a miraculous recovery. Chile’s stock market showed no significant decrease and its sovereign debt rating never decreased – in fact, both of these measures improved following the tragic event. The country’s resilience is even more remarkable given that a new Chilean president took office just ten days after the quake occurred.

Chile’s recovery is all the more astonishing because it is so atypical. Most countries that suffer catastrophes take years or even decades to recover. The United States, for example, is still paying for Hurricane Katrina’s damage a decade after the storm hit New Orleans. Similarly, Japan is still struggling to rebuild areas hit by the massive earthquake and tsunami it suffered in 2011.

At a seminar co-hosted this spring by the Penn Program on Regulation, as part of its Risk Regulation Seminar Series, the authors of the new book, Leadership Dispatches: Chile’s Extraordinary Comeback From Disaster, detailed the factors they found were responsible for Chile’s incredible recovery from the disastrous earthquake. The book’s co-authors, the Wharton School’s Michael Useem, Howard Kunreuther and Erwann Michel-Kerjan, wrote their book to pinpoint how Chile managed to respond so well to the tragedy, and what lessons other nations should learn from Chile’s triumph.

The authors began the discussion by highlighting the impact of the earthquake and showing how improbable the country’s comeback was. They then zeroed in on the central questions for the panel: How did Chile do it? And what can others learn from this experience?

Professor Useem put forth four arguments to explain Chile’s successful comeback. First and foremost was the leadership of Chilean President Sebastian Piñera, who took office less than two weeks after the earthquake occurred. Not a typical politician, Piñera is an economics PhD and successful former businessman who took a hands-on approach to leadership, constantly working and paying careful attention to details. He also did not shy away from setting lofty, yet strategic goals, like ensuring that all kids could return to school in roughly two months. This was a daunting goal, given that nearly a third of the country’s schools were destroyed.

The second explanation for Chile’s incredible recovery centered on the leadership of the cabinet members, the high-level government ministers who played pivotal roles in implementing the nation’s recovery strategies. In particular, the book’s authors touted the ministers of housing, health, the interior, and mining for their work in rebuilding the country. Professor Useem noted that two of the ministers (housing and mining) had no prior experience in those fields. Yet Piñera carefully selected them, reasoning that although they could learn about housing construction costs or mine safety procedures, he could not so easily teach them how to lead, manage a department, and most importantly, make things happen.

Third, the authors focused on Chile’s approach to financing the recovery. Following the quake, Chile increased its taxes temporarily. Together with Chile’s largely insured homeowner market, these economic factors allowed Chile not only to avoid large scale financial ramifications from the earthquake, but it was instrumental in seeing the Chilean economy grow at a rate of 6% just one year later.

The fourth explanation singled out the country’s long-term thinking that helped mitigate some of the quake’s initial damage and facilitate the recovery. Chile, which is situated along the Ring of Fire, had already experienced quite a few earthquakes. Because of its history with natural disaster, Chile has developed laws and practices over the years to deal with earthquakes. For instance, it has stringent building codes that are strictly enforced. It also imposes legal responsibility on developers for a building’s structural integrity for ten years after its construction. Furthermore, while not legally required, almost all homeowners in Chile have earthquake insurance because banks require it in order to get a loan to buy a house.

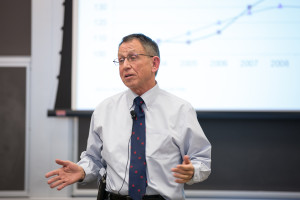

Erwann O. Michel-Kerjan, Executive Director of Wharton’s Center for Risk Management and Decision Processes

As successful as Chile’s recovery was, the three Wharton authors noted that there were still areas that left room for improvement. In particular, they mentioned some of Piñera’s statements following the earthquake. While reassuring the citizens of Chile that their country would be rebuilt, some of the announcements may have set expectations too high, or assumed for the president and his cabinet too much responsibility for reconstruction. Useem posited that some of Piñera’s statements following the quake may have led to his largely decreased public approval rating later on in his term.

Professor Kunreuther discussed the different types of thinking and systematic biases at play in Chile’s response to the tragedy. He identified two types of thinking – intuitive and deliberative. Most of us use intuitive thinking everyday, relying on simplifying factors like memories of previous experiences to help us make choices. The problem, Kunreuther explained, is that intuitive thinking is less helpful in the face of catastrophic events, where we often have no precedent to guide our decision making. That is where the more logical, effort-filled deliberative thinking must come into play. A major part of Piñera’s success in leading the country’s recovery was in fixing the short-term problems, but still thinking hard about solutions to long-term problems as well.

In 2014, Chile’s ability to learn from its experience in responding to the 2010 quake was tested, when it suffered another earthquake, this one with an 8.2 magnitude. The country fared remarkably well, having learned from its previous experience.

In 2014, Chile’s ability to learn from its experience in responding to the 2010 quake was tested, when it suffered another earthquake, this one with an 8.2 magnitude. The country fared remarkably well, having learned from its previous experience.

Chile’s comeback from the 2010 quake was enormously successful. Its speedy recovery was a key factor in Chile becoming the first Latin American country to be invited to join the Organisation for Economic Cooperation and Development, a global forum of 34 countries that seeks to improve economic progress.

Unfortunately, many other tragedies around the world are not followed by such a strong recovery, and instead the aftermath of major natural disasters can continue to plague countries for years. The lessons from Leadership Dispatches and the recent panel discussion organized around the book may hold important lessons for other nations and their leaders in how to prepare for, and manage, disaster.

The monthly Risk Regulation Seminar series at the University of Pennsylvania is regularly organized and sponsored by the university-wide Penn Program on Regulation, centered at the University of Pennsylvania Law School, as well as by the Wharton Risk Management and Decision Processes Center.

Michael Useem is the William and Jacalyn Egan Professor of Management at the Wharton School, where he is also the Director of the school’s Center for Leadership and Change Management. Howard Kunreuther is the James G. Dinan Professor, Professor of Operations and Information Management, Professor of Decision Sciences and Business Economics and Public Policy, and Co-Director of the Wharton Risk Management and Decision Processes Center. Erwann Michel-Kerjan is the Executive Director of the Risk Management and Decision Processes Center and teaches in Wharton’s Operations and Information Management Department.